Innovate Articles

Green Drive: Patents Fuel Japan’s EV and Hybrid Technology Surge

Mayo Komiyama

INTRODUCTION

Japan's automotive industry is globally recognized as a leading driver of sustainable transportation innovation, particularly in the areas of electric vehicle (EV) and hybrid electric vehicle (HEV) technologies.[1] [2] The collective efforts of Japanese patent holders, including industry giants and emerging players, on the strategic use of patents and international collaborations solidify Japan's leadership in this field.

HOLISTIC APPROACH TO INNOVATION

Japanese companies file a significant number of patents in the EV and HEV sectors. However, they do not merely focus on numbers. Rather, Japanese companies pursue a holistic innovation strategy, which in addition to patent filings, includes standardization activity and patent utilization, such as licensing and co-research & development.

More specifically, in the past decade, Japanese companies have made significant contributions to global patent filings in battery technology and electric motor drives, demonstrating a strong commitment to advancing these technologies.[3] Toyota, Honda, Sony, and Nissan are major Japanese leaders in EVs, while Panasonic is prominent in lithium-ion batteries.[4] Additionally, many Japanese companies in the automotive and related industries have been working on strengthening their business by leveraging international standardization such as charging standards and communication standards like 5G, and 6G related to the connected cars. [5] [6] The high-output charging standards that vehicles use to communicate with charging stations include Tesla, CHAdeMO, GB2, CCS1, and CCS2, etc.[7] Japan and China co-developed and released CHAdeMO protocol 3.0 in 2020.[8] Although the future of competition between the major charging standards is still unpredictable, continuous innovation in this field is crucial to the widespread of EVs.

ALLIANCES SHAPING THE INDUSTRY

Strategic alliances, both domestic and international, have been shaping the Japanese automotive industry. Such alliances take various forms of partnerships between automakers, including capital and technical tie-ins, joint R&D and production operations, and cooperative sales arrangements.[9] A notable domestic example is the partnership between Toyota and Panasonic to develop advanced battery technologies to accelerate the time to market for new hybrid models.[10] The Renault-Nissan-Mitsubishi alliance has been integral in pooling R&D resources, resulting in the launch of several successful EV models that have captured a significant share of the global market.[11] Panasonic has been collaborating with TESLA to supply lithium-ion battery cells.[12] One of Toyota's international partnerships is with CATL for new energy vehicle batteries.[13]

Standardizations require cooperation and adjustment of the power balance between participants across the world. Therefore, strategic alliances, such as those mentioned above, are crucial in ensuring that Japanese companies continue to set technology trends in the EV industry.

GLOBAL PATENT STRATEGIES

Navigating the global patent landscape, Japanese companies have been filing patent applications in key EV/HEV markets including the US, Japan, and other regions and countries to ensure the international presence of their innovations. For instance, their patent filing strategy often includes early fillings before the standardization meetings, and then amendments or divisional application fillings to follow up the standardization proceedings, because patents and standards are closely related as recited in the patent policies.[14]

The patent filing strategies may also include considerations related to companies' business plans and international deployments of future products and services. For example, Toyota's global patent investment in the CASE (connected, autonomous, shared, electric) field has increased steadily over the years, highlighting Toyota’s commitment to becoming a global leader in the EV market.[15]

Further, each country and region has its pattern of adapting EVs in line with national regulations, subsidy policies, and tax incentives.[16] For example, the EU lawmakers ban the production of conventional cars after 2035. Although those subsidies and tax incentives are said to be decreased over time,[17] Japanese players in the EV/HEV markets would have to adjust their patent portfolio development strategies, such as the number of patent applications in each region and country, according to the EV adaptation situation.

Additionally, the aforementioned increase in alliance leads to a surge in co-applicant patent filings among corporations.

INDUSTRY EVOLUTION

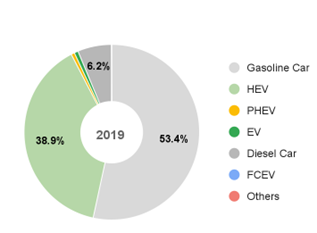

The economic and environmental impacts of Japan's focus on EV and hybrid technologies are far-reaching.[18] [19] In 2023, Electric car sales neared 14 million worldwide. [20] In the U.S., EV and hybrid sales grew to 16.3% of total new light-duty vehicle (LDV) sales in 2023.[21] In Japan, EV and plug-in electric vehicles (PHEV) together account for about 3.7% share, with HEV accounting for 55.1% share in 2023 shown in Figure 1 below. Toyota has been increasing R&D funding since the early 2000s in the EV as well as HEV sections.[22]

Figure 1 Market Share of New Passenger Cars Sold in Japan by Fuel Type in 2019 and 2023

Note: Fuel types include HEV (Hybrid Electric Vehicle), PHEV (Plug-in Hybrid Electric Vehicle), and FCEV (Fuel Cell Electric Vehicle). Data sourced from the Japan Automobile Manufacturers Association, Inc. Chart created by the author.

Figure 2 Increase in Next-Generation Vehicle Registration Share in Japan

Source: Japan Automobile Manufacturers Association, Inc., "The Motor Industries of Japan 2023."

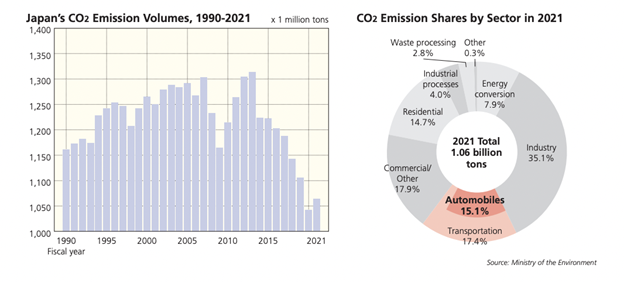

The bar graph in Figure 3 below shows that Japan achieved 20% reduction in CO2 emissions from 2013 to 2021.[23] One of the contributions to this achievement would be a green shift in the automobile industry because CO2 emission share from automobiles accounts for 15.1% of total emissions as shown in the pie-chart in Figure 3 below. The worldwide country policies to eliminate conventional cars are expected to accelerate the green shift for eco-friendly EVs, while the hybrid car still appears to rise due to its mix of robustness, affordability, and environmental features, especially in the region that has fewer electric vehicles charging stations.

Figure 3 CO2 Emissions in Japan

Source: Japan Automobile Manufacturers Association, Inc., "The Motor Industries of Japan 2023."

LOOKING FORWARD

The future holds both challenges and opportunities for Japan's automotive industry in the EV and HEV sectors. The deployment of automation and intelligent mobility could further intensify competition in the industry. Continued innovation, supported by strategic patenting and alliances, will be critical to maintaining Japan's competitive edge. By continuously adapting to the global shift toward more sustainable transportation solutions, Japanese companies are poised to lead the evolution of the automotive industry.

In addition, WIPO Green, which was originally proposed by the Japan Intellectual Property Association (JIPA), has many Japanese organizations, such as the Japan Patent Office (JPO) and companies, as WIPO Green partners. [24] One of the Green partners from Japan is Global Mobility Service Inc. which owns vehicle-related technology patents, promoting the replacement of old vehicles with new, low-emission models, thereby helping to improve air quality.[25] Such an initiative will assist sustainable green features through a patent system in new vehicle technical fields.

CONCLUDING REMARKS

The aforementioned strategic approaches to EVs and HEVs demonstrate a commitment by Japanese companies to innovation and global leadership. As the industry moves toward a greener future, the synergy between the patent strategy and international alliances so well adapted by Japanese companies will continue to drive progress in sustainable transportation technologies, solidifying Japan's leadership in this field.

[1] See. Power Technology “Q1 2024 update: electric vehicles related patent activity in the power,” ‘Toyota Motor filed the most electric vehicles patents within the power industry in Q1 2024.’ https://www.power-technology.com/data-insights/patent-activity-electricvehicles-power-industry/?cf-view

[2] See. Car and Driver “What Is a Hybrid Car and How Do They Work?” ‘Honda is the most recent champion of this type, which powers the latest iterations of the Civic, CR-V, and Accord hybrids.’ https://www.caranddriver.com/features/a26390899/what-is-hybrid-car/

[3] EV Industry Report “Trends in the industry” from SPEEDA database.

[4] Id.

[5] See. Torque News “Toyota Should Have Invested in Charging Infrastructure Like Tesla and This Is What Would Happen,” ‘Challenges and Considerations of Building a Nationwide EV Charging Network’ https://www.torquenews.com/1/toyota-should-have-invested-charging-infrastructure-tesla-and-what-would-happen

[6] See. Mitsubishi Electric Corporation Intellectual Property Activities “IP Strategy for International Standardization” https://www.mitsubishielectric.com/en/about/rd/ip/rights/index.html

[7] EVESCO “EV Charging Connector Types: A Complete Guide” https://www.power-sonic.com/blog/ev-charging-connector-types/

[8] ChadeMo “High Power (ChaoJi) High Power roadmap” https://www.chademo.com/technology/high-power#:~:text=CHAdeMO%203.0%20(ChaoJi)&text=CHAdeMO%20and%20China%20Electricity%20Council,towards%20a%20harmonised%20future%20standard

[9] “The motor industries of Japan 2023,” Japan Automobile Manufacturers Association, Inc., pp.25-26, “Japanese Automakers Forge Extensive International Alliances” https://www.jama.or.jp/english/reports/docs/MIoJ2023_e.pdf

[10] See. Panasonic Press Release “Toyota and Panasonic Decide to Establish Joint VentureSpecializing in Automotive Prismatic Batteries” https://news.panasonic.com/global/press/en200203-4

[11] “Renault-Nissan-Mitsubishi Alliance is the world’s leading automotive partnership,” ‘Solid Foundations,’ https://alliancernm.com/

[12] Panasonic Press Release “PANASONIC AND TESLA REACH AGREEMENT TO EXPAND SUPPLY OF AUTOMOTIVE-GRADE BATTERY CELLS” https://news.panasonic.com/global/press/en131030-4

[13] Toyota Newsroom “CATL and Toyota Form Comprehensive Partnership for New Energy Vehicle Batteries” https://global.toyota/en/newsroom/corporate/28913488.html

[14] See. Japanese Industrial Standards Committee “Patent Policy” https://www.jisc.go.jp/policy/patentpolicy.html

[15] EV Industry Report “Case study in EV `TOYOTA MOTOR CORPORATION`” from SPEEDA database.

[16] EV Industry Report “EV Market Rapidly Taking Shape as Regulations Tighten and Subsidy Policies Take Root; IRA Tax Credit Requirements Tightened” from SPEEDA database.

[17] Id.

[18] See. “Toyota is hitting the gas on hybrids as EV sales cool. But what does that mean for the planet?” https://edition.cnn.com/2024/03/10/climate/hybrids-evs-toyota-climate-impact-int/index.html

[19] See. Nissan Ambition 2030 “Accelerating electrified mobility with diverse choices and experiences” https://www.nissan-global.com/EN/COMPANY/PLAN/AMBITION2030/

[20] Global EV Outlook 2024 “Electric car sales” https://www.iea.org/reports/global-ev-outlook-2024/trends-in-electric-cars

[21] In-brief Analysis, U.S. Energy Information Administration, “Electric vehicles and hybrids surpass 16% of total 2023 U.S. light-duty vehicle sales” https://www.eia.gov/todayinenergy/detail.php?id=61344

[22] R&D sections of the Toyota’s IR information from 2004 to 2023 from SPEEDA database.

[23] See. COP28, Japan Ministry of Environment, p.3, “Japan's progress towards Net Zero 2050” https://www.cas.go.jp/jp/seisaku/gx_jikkou_kaigi/dai9/siryou2.pdf

[24] Collaboration with WIPO GREEN, JPO, “Partners,” https://www.jpo.go.jp/e/news/kokusai/green.html

[25] Id. “Activities of Japanese Partners Global Mobility Service Inc”

Mayo (Maya) Komiyama is a patent attorney in Japan. Graduated from the University of Washington School of Law with an IP LLM in 2023 and subsequently interned at Bracewell LLP and Seed IP Law Group LLP from 2023 to 2024. Before LLM, she assisted various clients with patent prosecution in the EE/CS field, due diligence, and IP portfolio management at TMI Associates in Tokyo. This article does not represent the official views of the firms to which the author belongs.